A Misunderstood Compounder with ESPN's Brand Moats & Parks' Pricing Power | DISNEY (Part III)

CHARTS, CHARTS, CHARTS! about the 1) Branding Moats of ESPN: The Netflix of Sports and 2) Engines of Pricing Power behind Experiences

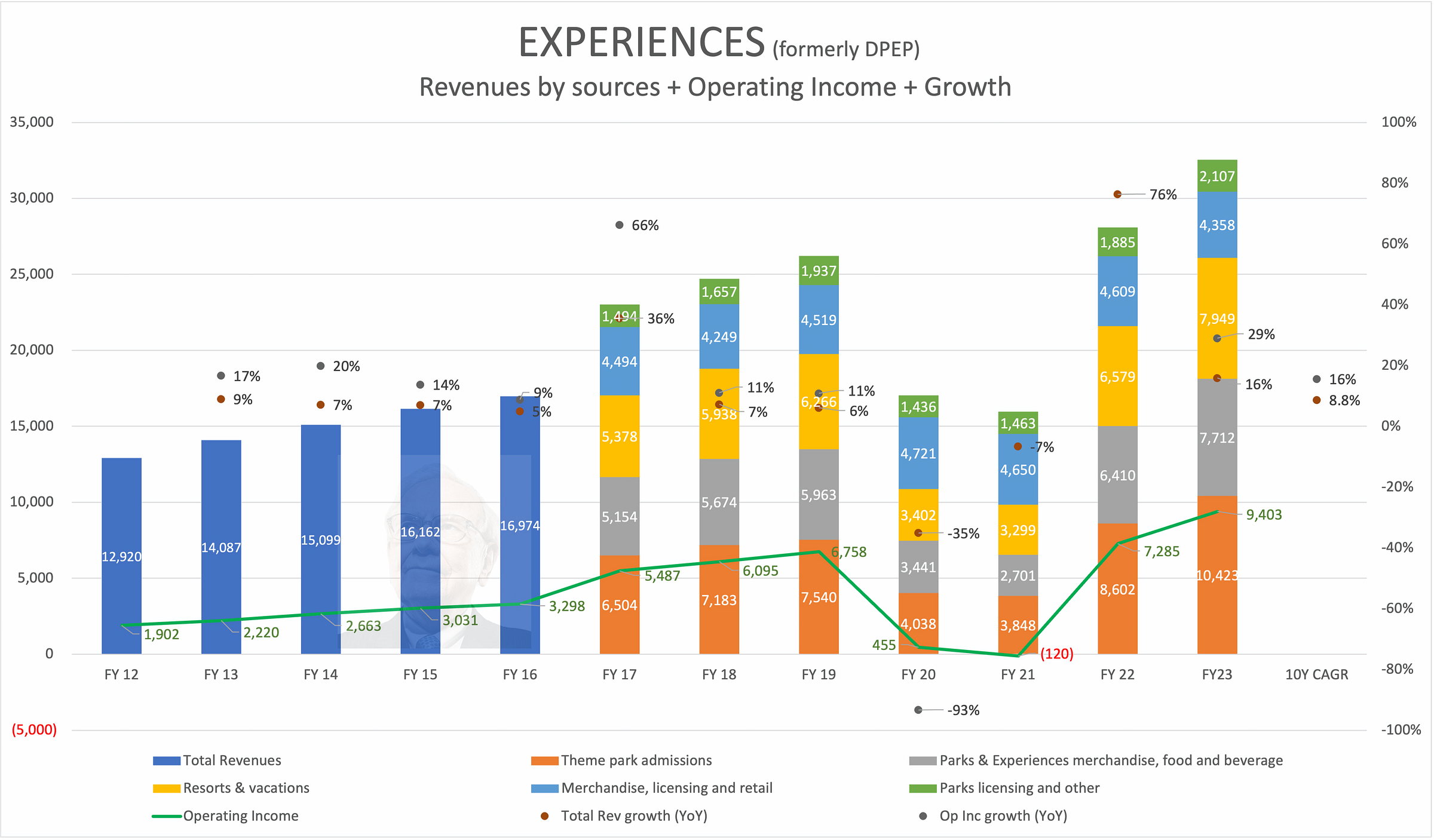

In last week’s Part 2 report, we covered some of the uncertainty that is causing markets to waver over Disney’s DTC segment (i.e. Disney+). But even amidst the depressive overhang of Disney’s Media business uncertainty, there has been a bright spot — its newly-restructured Experiences business segment (formerly DPEP). Against even my wildest expectations, Disney’s Parks have surprised to the upside with a 10Y historical revenue CAGR of 8.9%; and a startling 10Y historical Operating Income CAGR of 16%. How did Disney achieve this astounding outperformance at its Parks businesses? As we shall explore later in this Part 3 report, it’s largely contributed by unbelievable Pricing Power resulting from careful attention to ROIC and Optimal Capital Allocation — all hallmarks of an ‘Outsider CEO’ approach.

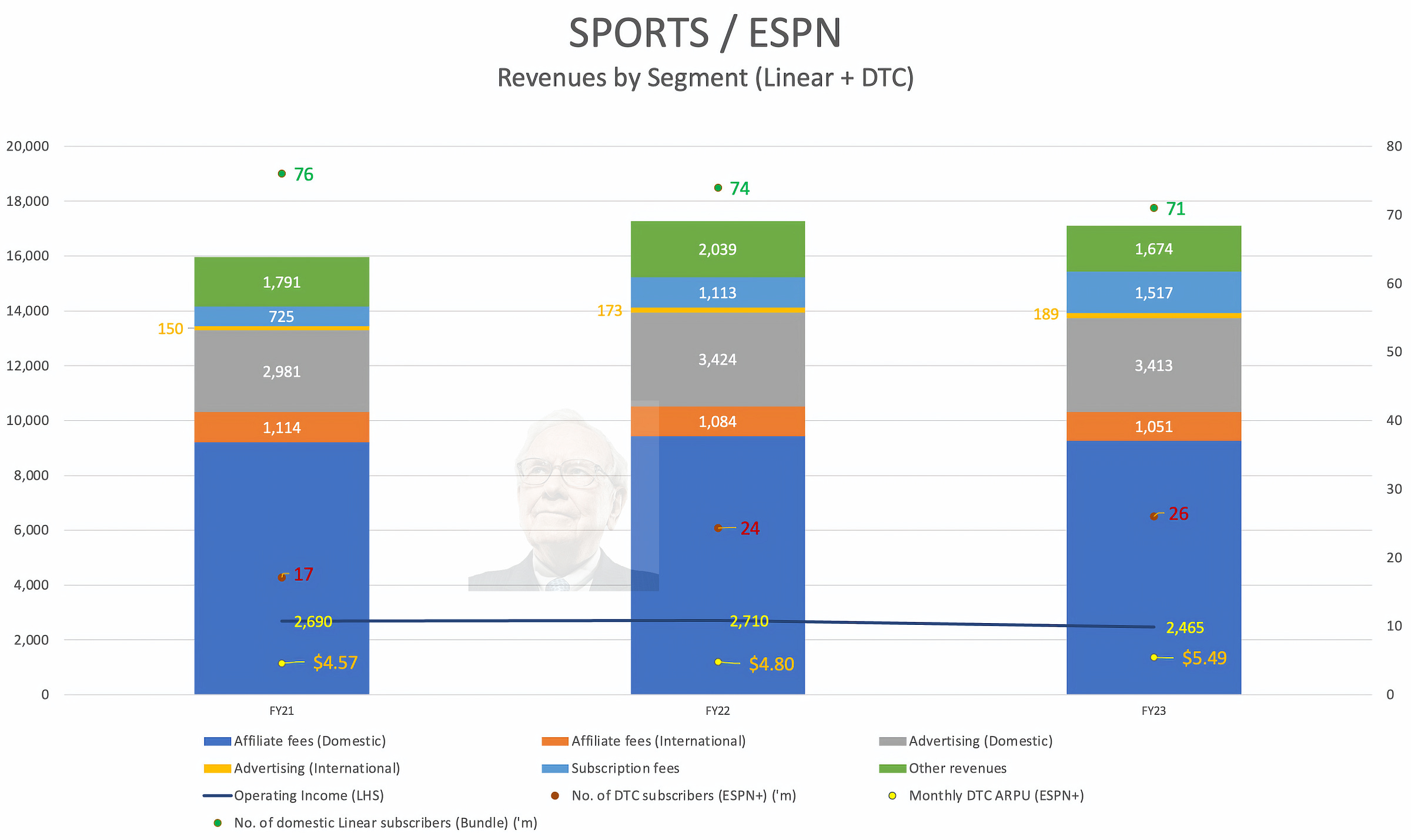

But wait, there’s more. As we’ve discussed previously in Part 1, ESPN commands nearly 20% of all1 US Linear TV ad revenues (source: Nielsen). Disney recently reorganized its reporting segments into 3 new business segments — Entertainment, Sports (both formerly combined under DMED/Media) & Experiences (formerly DPEP/Parks). Breaking Entertainment out of DMED allows owners to make a closer apples-to-apples comparison between its financial performance and Netflix’s (i.e. similar scope). Meanwhile, separating Sports out as its own reporting segment demonstrates the significance by which management thinks of ESPN’s future Group contribution.

As we shall see below, there’s another huge reason why ESPN might have been carved out of DMED — it enables visibility into how resilient ESPN’s financial performance has been on a standalone basis, without being clouded by the painfully costly DTC transition of Disney+ while they were both still combined under the former DMED segment.

I want to give a huge shoutout to Alex from The Science of Hitting Substack (TSOH), who very graciously allowed me to lean on his research while analyzing Disney. His incredibly detailed insights into Disney were extremely helpful in conducting my research, and I will be generously linking back to his articles throughout my report. I consider TSOH as the premier investment newsletter for Big Tech on Substack; in the same way that I consider SemiAnalysis for Semiconductors. Please visit his newsletter at the link above and show your support to him.

Click the Sections below to see our latest articles!

ESPN: The Netflix of Sports

ESPN Revenue Analysis

ESPN’s Surprising Economics

ESPN Operating Income Analysis

ESPN+ Transition to DTC So Far

Rebundling Solves ESPN+

Disney’s New RSN Model?

Preeminent Digital Sports Platform — Partnering with Tech Megacaps?

Tech Megacaps Are No Threat to ESPN

The ESPN Brand Moat — Unassailable Mindshare

ESPN BET

Keep reading with a 7-day free trial

Subscribe to Value Investing for Professionals to keep reading this post and get 7 days of free access to the full post archives.