PHARMANIAGA's (7081.KL) Share Price Fell By -40% Overnight! Is the "Pfizer of Malaysia" About To Go BANKRUPT?

Or Is This Government-Linked National Duopoly With Massive Business Moats Finally Undervalued Today - With A Market Cap of Just RM 350M (USD 80M)?

PHARMA’s pharmaceutical operations just entered the dreaded PN17 status!

Is the company under any material cash flow pressure, and does it face any immediate delisting or going concern risks? What’s the worst-case scenario for PHARMA?

Just because its share price has fallen by -40% overnight… doesn’t automatically imply that its fundamentals are undervalued! Can this Government-Linked Duopoly with Massive Business Moats justify its current market cap?

At its current share price, PHARMA trades at a ~x multiple… find out more about its valuation by signing up for a free trial here!

News broke last night that one the Malaysian pharmaceutical duopolies Pharmaniaga (PHARMA) entered into PN17 status, when it released its 4Q22 results yesterday. For the uninitiated, PN17 is basically a path towards delisting — Capital A was under the same regulatory crosshairs recently. In PHARMA’s case, they triggered it when they recognized a colossal RM 550M impairment on their excess Sinovac vaccine stockpile in 4Q22 — which led to their Total Equity falling into negative territory.

I like to call PHARMA the “Pfizer of Malaysia” — not only is it a Big Pharma company, it’s the one of only two listed Big Pharma suppliers that’s allowed to supply the vast majority of pharmaceutical goods to the entire country’s healthcare sector. This industry phenomenon is partly because of 3 reasons:

The pharmaceutical sector’s business model infamously involves outsized capital intensity and uncertainty;

There just isn’t enough scale in the USD400B GDP Malaysian economy for the pharma industry to innovate in a sustainable risk-adjusted manner; and

The Malaysian government subsidizes all public healthcare under a single-payer system.

As a result, there’s only enough room in the national Malaysian pharmaceutical industry for two players to operate at sustainable scale. One is the aforementioned government-linked PHARMA (7081.KL), and the other is the privately-owned Duopharma Biotech (7148.KL). However, this double-edged sword is also a good thing for both players as a business concern — especially in PHARMA’s case, as that makes it a quasi-governmental duopolistic entity.

Hence, when PHARMA’s share price fell by -40% today over the PN17 concerns, my interest was immediately piqued. It was unlikely that the government would allow PHARMA to go bankrupt, as that would grind half of the entire country’s pharmaceutical supplies to a halt. In my view, the only real risk to shareholders would be a government bailout that could potentially significantly dilute its share count.

Chapters In This Stock Report:

Pharmaniaga (7081.KL):

Learn more about PHARMA’s latest developments by reading the news articles below:

Massive RM552.3 million vaccine provision pulls Pharmaniaga into deep losses, triggers PN17

Pharmaniaga at risk of large vaccine inventory impairment

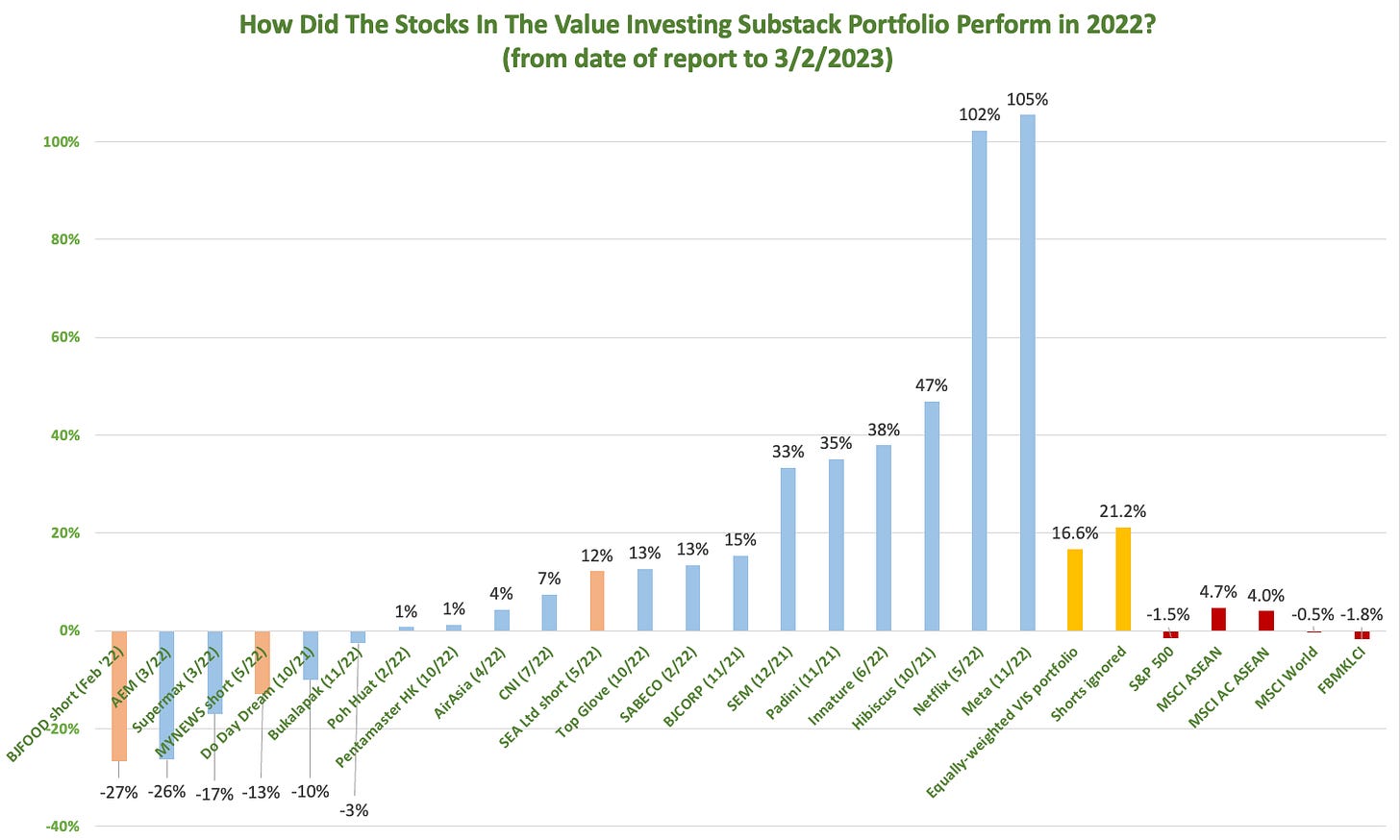

The Value Investing Substack Portfolio Outperformed The S&P500 By Over +16.6% In 2022! Click the link below to find out more!

Does PHARMA Face Any Going Concern Risk?

Keep reading with a 7-day free trial

Subscribe to Value Investing for Professionals to keep reading this post and get 7 days of free access to the full post archives.