Pentamaster International Ltd (1665.HK) - The Closest Thing to Arbitrage in East Asia

Malaysian listed shares: 37x PE. Dual-listed Hong Kong shares: 9x PE.

Pentamaster International Ltd (1665.HK) is a Hong Kong listed company - representing a semiconductor testing equipment business that is actually domiciled in Malaysia. Curiously enough, the business also has a dual-listed Malaysian counterpart - in Pentamaster Corporation Bhd (7160.KL).

The latter’s participation in the underlying business actually happens via a 63.9% ownership of the former - this is easily observable from the Malaysian entity’s P&L, where exactly 63.9% of its Total Comprehensive Income is attributable to owners of the company (with the remainder belonging to Non-Controlling Interests). However, the shares of both entities are non-convertible with one other.

The interesting dichotomy here is that while both companies represent the exact same underlying business - in fact, the Malaysian listed entity indirectly owns the underlying business through the HK listed entity - the Malaysian shares trade at a whopping 37x PE; while the HK shares trade at just 9x PE. Non-convertible status notwithstanding, efficient market hypothesis would dictate that at least some form of arbitrage exists here.

Furthermore, there are decently high-growth prospects behind the existing Pentamaster business - which is actually highly visible in the 37x multiple that the Malaysian shares are already trading at. The point is that you don’t even need to read the rest of this report to be convinced that this growth potential exists - Malaysian markets are already pricing in such growth. The only question that remains is - why are the HK shares being offered for so cheap? And what are the risks involved?

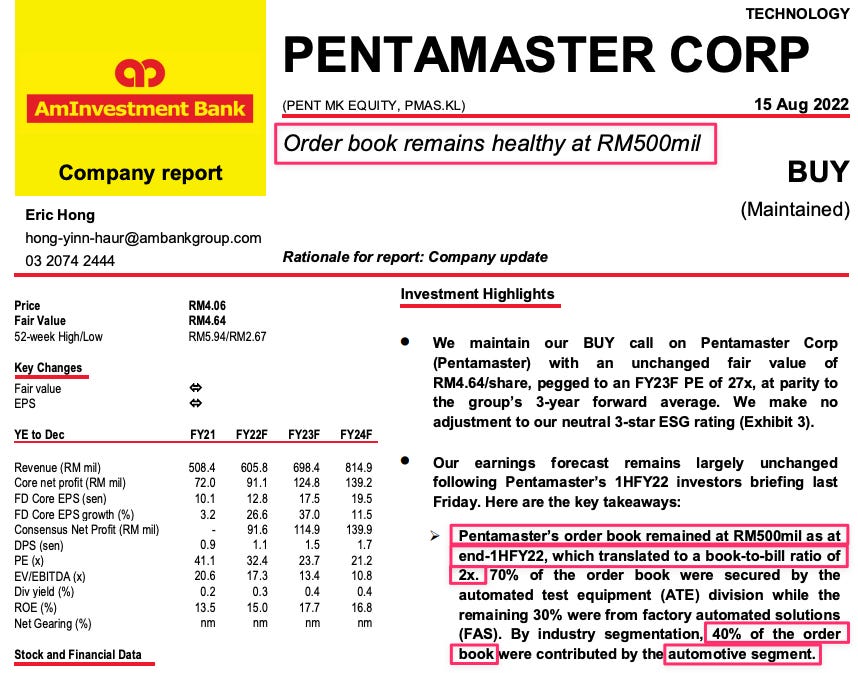

Oh, and did I forget to mention that the HK shares currently trade at just 7x of the Net Cash on the company’s balance sheet? And that they currently have an order book worth RM 500M (USD 100M)? And that their FY21 ROIC was 40%? And that the small Malaysian island of Penang where they are located controls 7% of global industry‘s TAM?

If all this has tickled your curiosity, sign up for an affordable subscription below right now to discover what this stock has to offer!

“If this is what a commoditized business looks like, who needs Moats?”

Chapters:

Semiconductor Testing Equipment Industry Primer - Not As Commoditized As It Seems?

Pentamater’s Business Segment Performance & Industry Growth (the interesting part!)

Pentamaster HK (1665.HK) Links:

Company’s corporate information & financials (look for ‘Headline Category & Document Type’)

Check out my related report below about a key supplier of semiconductor testing equipment to Intel INTC 0.00%↑ - AEM Holdings!

We also have a sister news blog for daily market news, Value Investing Substack NEWS. Click the box above to check it out!

Executive Summary (640 words)

Keep reading with a 7-day free trial

Subscribe to Value Investing for Professionals to keep reading this post and get 7 days of free access to the full post archives.