🚅 Canadian National Railway Deep-Dive - The Epitome of Asymmetric Risk:Reward (NYSE:CNI)

Positive Catalysts: US Commodities, CPKC merger, Pivot to Growth (from PSR), Intermodal Business Model Shift, Decarbonization, Nearshoring in Mexico, Market Share Capture from Trucking... & More!

Click here to read our Part 1: Industry Primer of Class 1 US Railroads!

Who knows? We might even see the emergence of “no-frills” rail service one day.

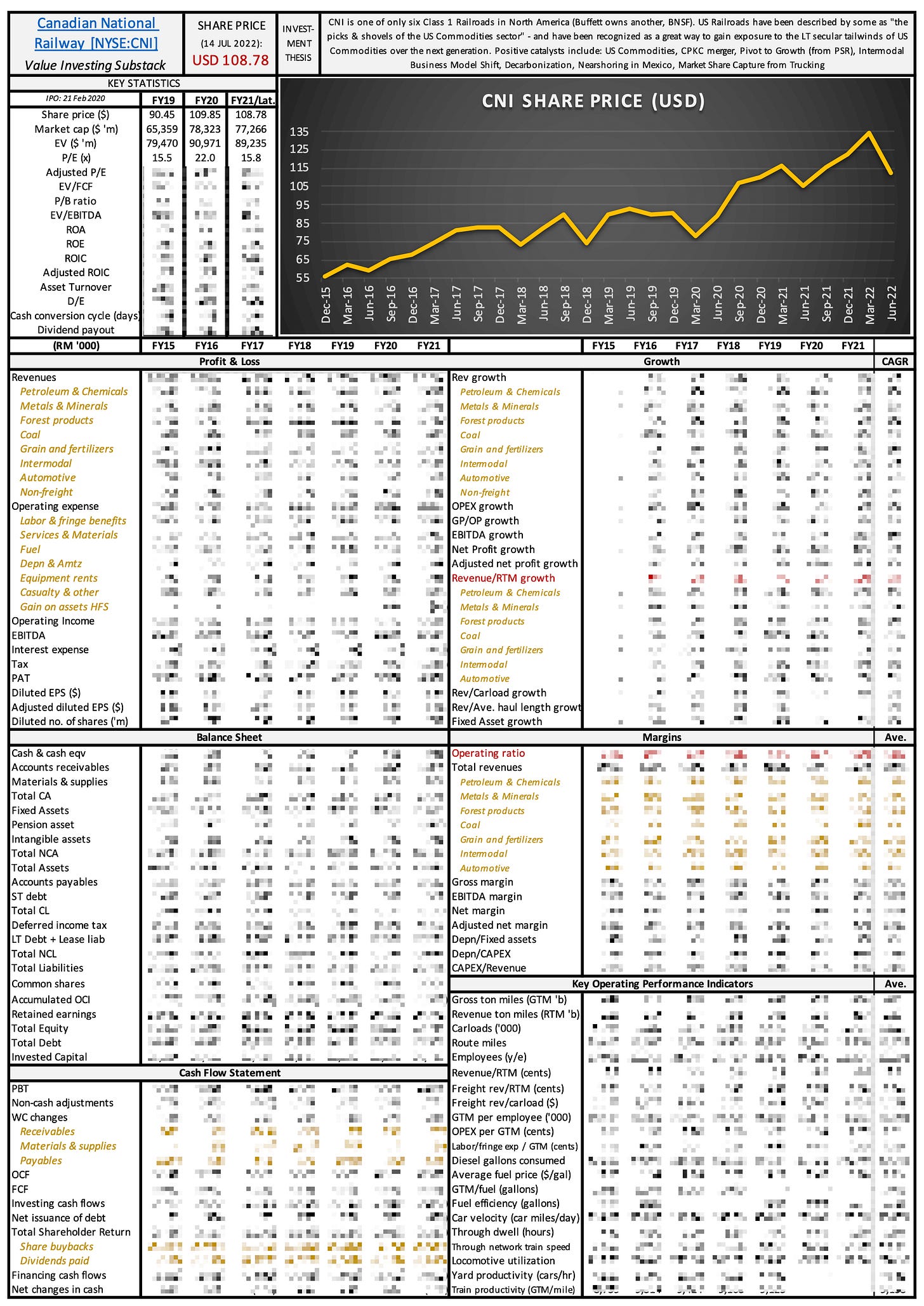

In my last report, we explored how Class 1 Railroads benefit from a host of monopolistic-like business advantages - and how Precision Scheduled Railroading (PSR) essentially re-engineers the traditional railroad business model from the ground-up for maximum operating efficiencies. The latter’s performance can be expressed in an improving Operating Ratio (%) - which is just unit costs/unit revenues (i.e. lower = better). Given the railroad industry’s relatively flat volume growth over the past decade, obtaining a lower operating ratio has since been recognized by industry observers as a comprehensive KPI by which overall railroad performance is measured.

However, the utility of the operating ratio amongst Class 1 Railroads has gradually declined - having recently plateaued at around 60% after first being introduced nearly two decades ago. Recognizing the lack of further operating efficiencies to be squeezed from the “slash-and-burn” tactics employed by PSR advocates, the railroad industry has recently pivoted towards a focus on revenue growth. This paradigm shift had begun to take root even prior to the start of the pandemic, before all the macro tailwinds as discussed in my previous article had manifested - i.e. supply chain woes, Biden’s Green Wave policies and recent oil price tightness.

In this CNI 0.00%↑ stock report, we shall discuss all of the relevant drivers of future revenue growth for North American Class 1 Railroads - of which there are plenty. Here are some of the major ones:

Intermodal & Growth - and the increasing likelihood of rail-trucking M&A

Pivot from Shrinkage (PSR) to Growth (customer centricity)

Energy play (i.e. decarbonization & higher-for-longer oil prices)

Geopolitical (e.g. trade) & Government policy (e.g. pipelines, decarbonization, near shoring, USMCA)

(The above links which jump to the relevant chapters will only work in the desktop version of Google Chrome. If you’re using a different browser, please scroll to the relevant chapters below)

Paid subscribers can download this 1-page summary sheet + a 300-row Excel financial model of CNI’s historical three statements… at the bottom of this report!

Refresh your memory with our industry primer of Class 1 US Railroads below!

Executive Summary

Initially, CNI first caught our attention because value investor Sarah Ketterer of Causeway Capital recently added to her stake in CNI. Further digging revealed a bevy of recent developments - Bill Gates’ family office Cascade Investments had reduced its stake in CNI by about 10% in 2Q22; while long-time investor TCI Fund Management launched an activist campaign which ultimately pushed out former CEO Jean-Jacques Ruest (he was backed by another longtime investor). His replacement will be Tracy Robinson, who is joining from Canadian energy pipeline operator TC Energy and has also spent 27 years at rival railroad Canadian Pacific (CP).

Click the link below to download TCI’s Aug 2021 presentation against CNI:

Jean-Jacques Ruest’s outster was motivated by CNI’s failure to secure the merger with fellow Class 1 Railroad Kansas City Southern (KSU 0.00%↑ ), after the latter decided to pursue a merger with its initial suitor CP. This merger was monumental for several reasons - it was the first attempt at a merger between two Class 1 Railroads since 1999, and created the first truly end-to-end merger of a transcontinental railway in North America spanning Canada, the USA and Mexico. The resulting CPKC railroad has redrawn the battle lines in the industry, raising protest from most of the other Class 1 Railroads.

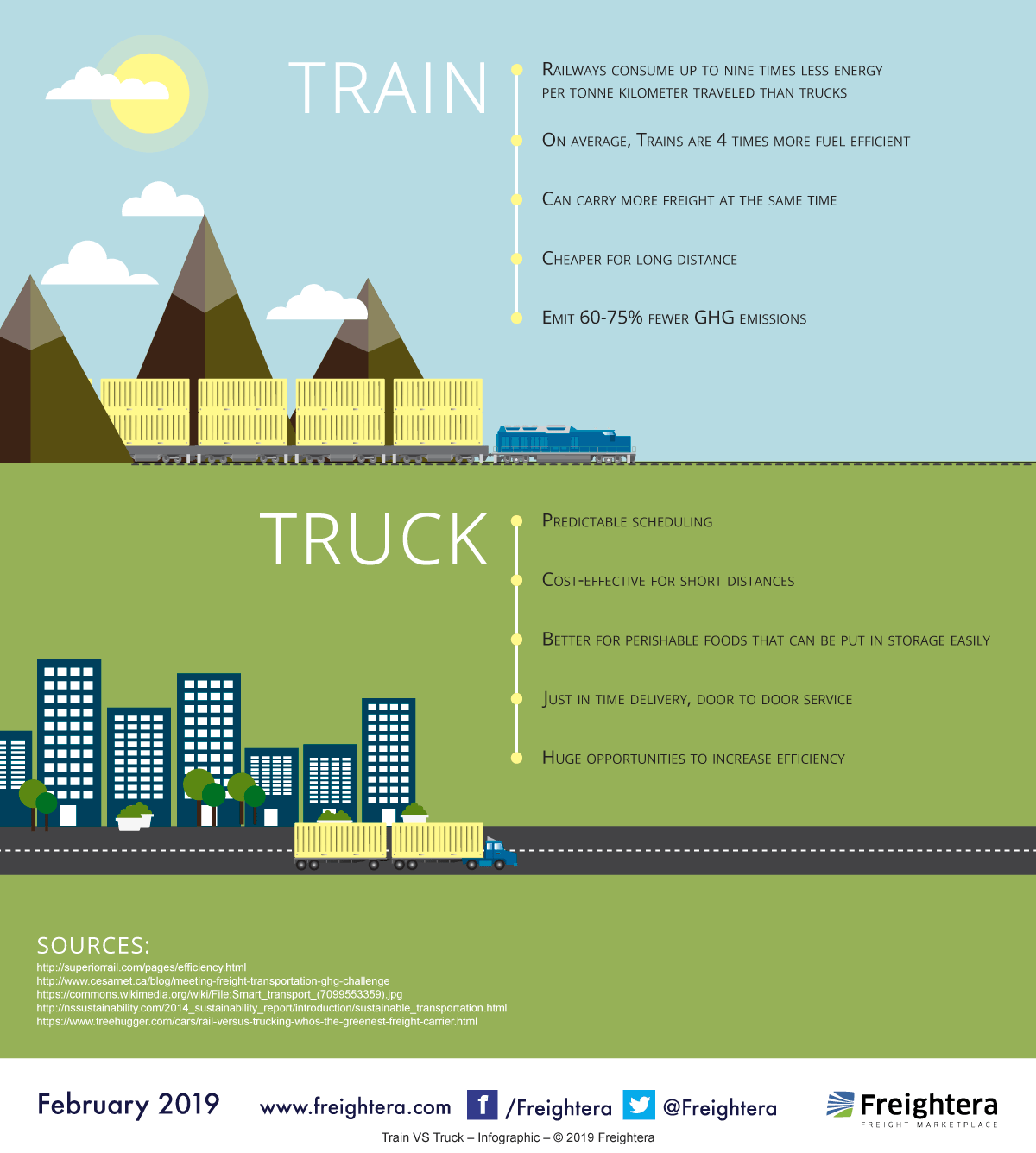

In addition, the railroad industry has recently embraced a paradigm shift away from containing costs (i.e. PSR) to growth - with the recent supply chain woes raising the profile of Intermodal as a freight option. This trend shift coincidentally aligns with recent government policy in favor of decarbonization & massive freight inflation - given how freight by rail tends to be 3-4x more fuel efficient, 2x cheaper even when accounting for intermodal, and emits 10x less greenhouse emissions than US Trucking.

However, while on the surface it seems that all is sugar & spice for the railroad industry, a quick look under the hood reveals the existence of a few worms in the can. Namely, the storied market share capture of Railroads from US Trucking has faces some obstacles - as well as the presence of several medium- and long-term headwinds. While these issues are relatively simple to grasp, they do not necessarily align with the macro picture at the highest level and need to be appreciated by investors.

With CNI trading at roughly 20x PE today, there exists asymmetric risk:reward - especially amidst these volatile markets. In this report, we’ll break down all of these factors to their component parts and seek to unravel their secrets.

Earth-Shattering CPKC Merger

As I’ve already covered the investment thesis for US Railroads as the picks & shovels of US Commodities in my previous article, I won’t repeat it here. If you’d like a refresher, head over there to explore the immense tailwinds filling the sails of North American Class 1 Railroads:

Keep reading with a 7-day free trial

Subscribe to Value Investing for Professionals to keep reading this post and get 7 days of free access to the full post archives.