✨ 7-11 Malaysia ('SEM' - 5250.KL)

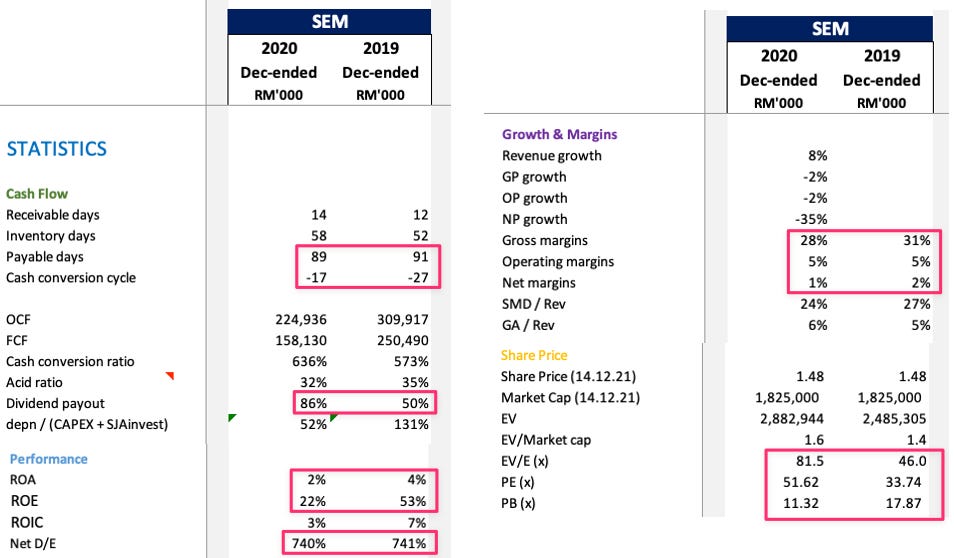

What if you could buy a potential inflation play with 30% ROE for only 30x EV/E?

7-11 Malaysia has an interesting financial profile - a negative Cash Conversion Cycle, a D/E ratio of 740%, and a 80%-100% historical dividend payout ratio.

They also have 2,400 stores in Malaysia - equivalent to 72 stores per million population. For reference, 7-11 USA only has 27 stores per million population.

In light of BJCORP’s recently announced turnaround, there is a lot of room for SEM to improve its future prospects - which I’ve also covered extensively in my recently published BJCORP Part 2 report:

7-11 is perhaps the most ubiquitous convenience store brand the world has ever heard of. Founded in America but later acquired by the Japanese, its global HQ now trades on the Tokyo Stock Exchange under the company Seven & i Holdings Co. Ltd (3382.T).

So perhaps it should come as no surprise that 7-11 Malaysia also has a listed entity, trading on the Bursa Malaysia under the company 7-11 Malaysia Holdings Berhad, or the ticker ‘SEM’ (5250.KL). And if you guessed that SEM basically represents all of the 7-11 convenience stores in Malaysia… you’d be correct.

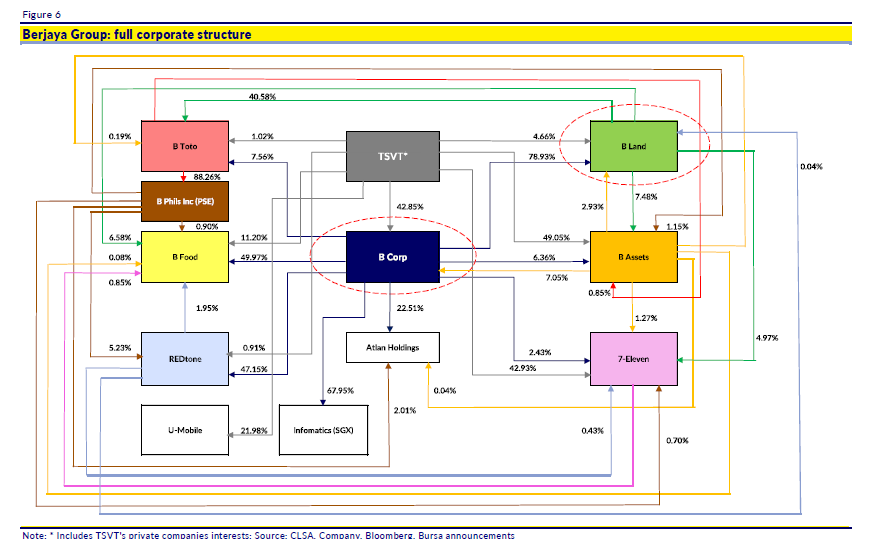

If you’ve read my earlier reports about BJCORP which were published within the past month, you’ll know that SEM is mostly owned by BJCORP’s founder Tan - the 24th richest man in Malaysia according to Forbes. Tan currently directly owns about 43% of SEM’s outstanding shares, while BJCORP directly owns about about 2% of SEM’s outstanding shares. However, if you add up the web of cross-shareholdings and delegated voting rights from all the other Berjaya entities who also partly own SEM, it’s fair to assume that Tan controls approximately 50% of SEM’s outstanding shares:

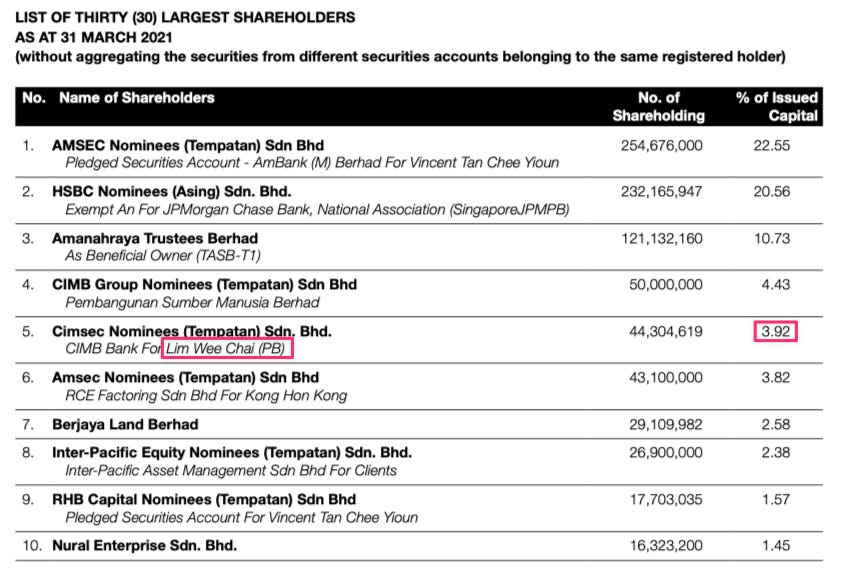

One funny observation that can be made is that the founder of Top Glove (7113.KL) - Lim Wee Chai (currently the 8th richest man in Malaysia) - also owns about 4% of SEM’s outstanding shares, for some reason. You may have heard of Top Glove (the world’s largest glove manufacturer) when it made headlines last year as one of the biggest beneficiaries of the COVID-19 pandemic; and subsequently became one of this year’s worst performers amidst the pandemic’s gradual recovery:

Anyway, the point I’m trying to make is that Tan basically has control over SEM despite his mere 43% direct stake - or could easily acquire a negligible % of outstanding shares in order to secure direct control over SEM. Hence, if we can make the assumption that BJCORP’s CEO Jalil and its founder Tan are aligned with regard to their objectives for BJCORP, it subsequently implies that a Tan-controlled SEM is effectively a Jalil-controlled SEM.

SEM’s Company Links:

Company’s historical financials on TIKR (free sign-up required)

Financials

Keep reading with a 7-day free trial

Subscribe to Value Investing for Professionals to keep reading this post and get 7 days of free access to the full post archives.