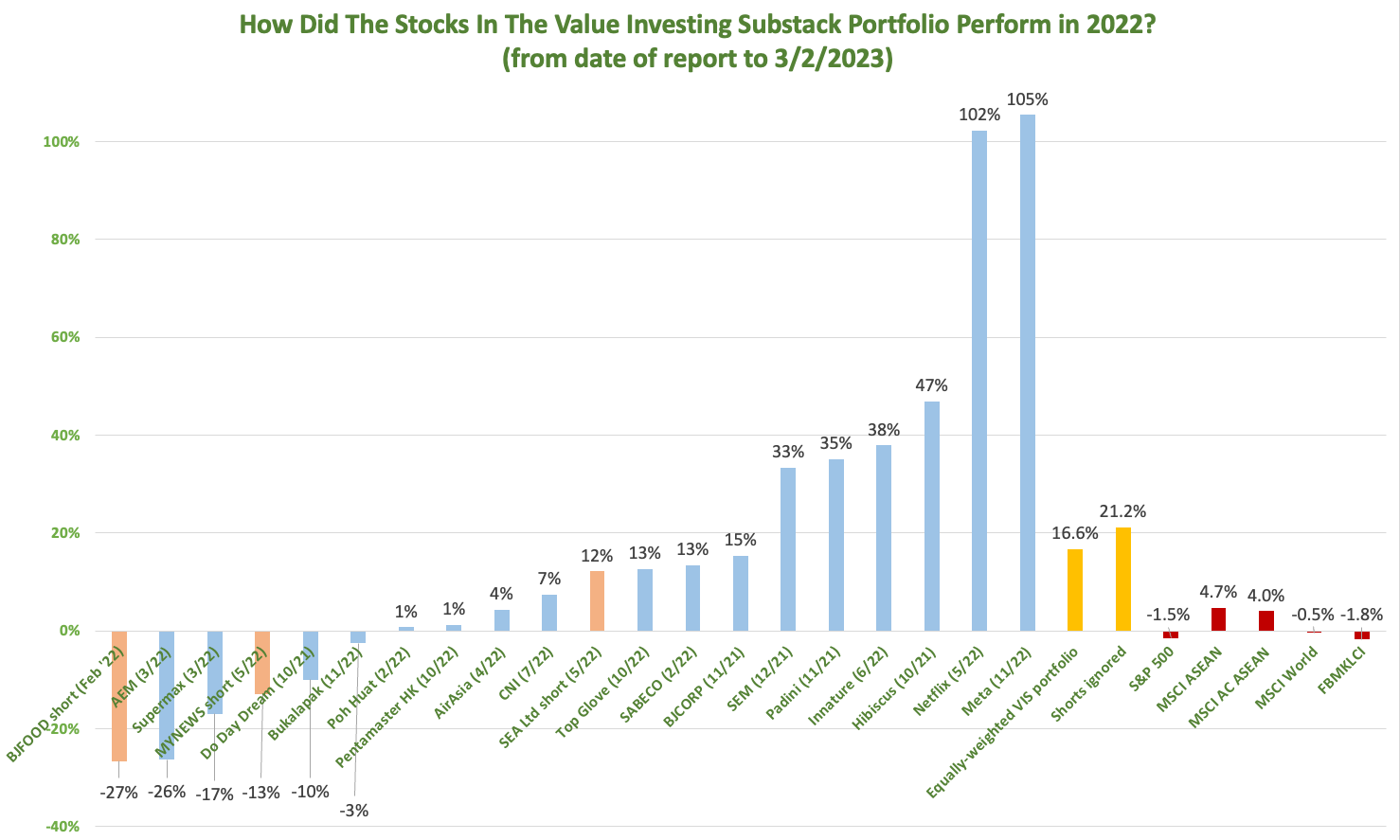

The Value Investing Substack Portfolio Gained +16.6% In 2022, While the S&P 500 Lost -1.5%

An Equally-Weighted Portfolio in all the stocks on Value Investing Substack would have delivered +16.6%. Over the same period, DCA-ing into the S&P500 would have lost -1.5%. Value Investing Works!

Most of you reading this will know me by now as, “That Value Investing Guy on Substack”, and I have made no bones about the fact that I am a true believer of The Warren Buffett Way of investing. If you are new to this newsletter, allow me to regale my tales about the wonders of the value investing methodology in the articles below:

However, when all is said and done, the aforementioned articles remain theory. A common question I get from my guests is, “so what do your actual real-life results from practicing such a value investing philosophy look like”? Fortunately, I get to put some meat on those bones today.

The above chart & table represents all the stocks that I have written reports on since this newsletter went paid in Oct 2021. Initially, I wanted to include all the stocks that I had written about to-date since the inception of this newsletter in Jan 2020. However, I later realized that I had to cherry pick which stocks would be given consideration had I done that — since some of my articles before I went paid were just written casually, without having done much research beforehand. In order to minimize the influence of subjectivity in this performance attribution, I simply opted to only include the stocks which I wrote reports on after the newsletter went paid — i.e. starting with my first paid report in Oct 2021, Hibiscus Petroleum Berhad: Episode 3 - Revenge of the Supply Chain.

The aforementioned chart and table is quite self-explanatory, and I’ll provide more explanation in the Performance section below. Basically, I’m assuming that I have invested in each stock on this newsletter after Oct 2021 at the first time of writing (some stock reports were written over several parts) — and have assumed that they were invested in an equally-weighted manner (i.e. 5% each of 20 stocks). The adjacent table simply expresses the chart in table form, while also including the equivalent performance had the same amounts been invested into the respective benchmark index at the same times in an equally-weighted manner (i.e. DCA). Strictly speaking, this isn’t 2022’s performance alone because the performance timeframe is from 4Q21 - Jan ‘23 (i.e. 16 months) — but I thought that was close enough to describe as “2022”. Regardless, it doesn’t really matter in a practical sense — since if you extend the timeframe by another 4 months, the market could either go up or down.

To be clear, this isn’t how I have invested my own personal portfolio — due moreso to lack of capital than intent — nor is it how I would have managed a professional portfolio, since no professional portfolio invests in an equally-weighted manner. However, I didn’t write my stock reports with historical performance attribution reporting in mind, and I needed to provide some sort of objective baseline which still allowed others to adjust as they saw fit (given that all of the above information is public). This just seemed like the simplest way to do it.

Nevertheless, my accountability to my readers isn’t how I have invested my own portfolio, but rather how the ideas that have been presented on this newsletter thus far have performed. Hence, I think this is still a fair form of accountability as far as this newsletter is concerned.

Assumptions

All the stocks on this newsletter after Oct 2021 have been invested in an equally-weighted manner (i.e. 5% each of 20 stocks)

The stocks on this newsletter were invested in on the first date that I wrote about them, and a “buy-and-hold” strategy had been exercised to-date (i.e. no stocks had been sold)

The stocks which I didn’t write favorably about were shorted — however, an alternate performance measure which assumes that they had been ignored instead is also shown (i.e. “shorts” ignored).

As mentioned above, I have opted to assume that all the stocks on this newsletter after Oct 2021 have been invested in an equally-weighted manner across the Value Investing Substack portfolio (i.e. VIS) to keep things simple. This sample VIS portfolio also assumes that the stocks on this newsletter were invested in on the first date that I wrote about them — and that a “buy-and-hold” strategy had been exercised since the date of investment (i.e. no stocks were sold).

I needed to add in this assumption because some of the stocks that I had written about had been written across several parts — and might have caused some confusion about the assumed initial timing of investment if I didn’t mention it. Also, a “buy-and-hold forever” strategy is pretty much how many value investors invest, so I don’t think it’s straying too far from the beaten path. Lastly, the above VIS portfolio assumes that the stocks which I didn’t write favorably about have been shorted. To minimize the role of cherry picking, I have also included the performance of the aggregate portfolio if we had simply ignored these stocks rather than outright shorting them. This is an oversimplification — but readers are free to adjust the positions as they see fit, since all the stock names, date of publications and their share prices at the time are public.

In the adjacent table, you can see the prices of a few selected benchmark indexes over time — i.e. S&P 500, MSCI ASEAN, MSCI AC ASEAN (without Vietnam), MSCI World and the Malaysian KLCI index. The performance of the benchmark indexes are arrived at by assuming that the same amounts had been invested at the same time as when the investments in the equally-weighted sample VIS portfolio had been made — e.g. if 5% of the portfolio had been invested into Hibiscus on 10 Oct 2021, then a like amount would have been invested into the S&P 500 on that same date.

In an equally-weighted portfolio, this basically assumes that you had been diligently Dollar-Cost Averaging (DCA) into those indexes at exactly those same dates. Once again, the prices of these indexes are all public and can be easily verified (source: Bloomberg).

Performance of VIS Portfolio Over 2022

Now that we have set up all of our assumptions, we can begin to analyze how well I performed over 2022. As I’ve mentioned, this isn’t strictly 2022’s performance alone because the performance timeframe is from 4Q21 - Jan ‘23 (i.e. 16 months) — but I thought that was close enough to describe as “2022”. Regardless, it doesn’t really matter in a practical sense — since if you extend the timeframe by another 4 months, the market could either go up or down.

As you can see at the bottom of the stock performance table, an equally-weighted portfolio in all the stocks on this newsletter (invested at the time of their first writing here) would have delivered a 16-month return of nearly +16.6%. That performance actually jumps to 21.2% if we were to remove the stocks that were “shorted”.

This performance is startling when compared against the benchmark indexes as described above. Under the same investment approach, the S&P500 index would have actually lost -1.5% over the same 16-month period — while the perhaps more comparable MSCI ASEAN index increased by only +4.7% over that time. This would put the VIS portfolio’s alpha (i.e. excess returns) at >350% that of even the best-performing selected benchmark index (i.e. 16.6% / 4.7% = 3.5x).

This is all the more impressive when you consider that the 16-month period of this timeframe was bookended by two cataclysmic macroeconomic events — the Ukraine War and the US Inflation scare of 2022. While the tail-end of this timeframe did coincide with a more optimistic market environment following China’s reopening in December, most of the +16.6% gains were made prior to then.

This is an excellent opportunity to demonstrate how a risk-adjusted return investment approach can deliver superior long-term returns in excess of a profit-maximizing one. As I mentioned in this value investing article, every dollar lost in the stock market offsets one dollar gained — hence avoiding losses becomes just as important as cultivating gains in pursuing the wealth maximization objective. And given how devastating the COVID period had been to many stock portfolios, it is nothing short of a miracle that this sample VIS portfolio was able to post any gains at all — much less >350% of how the best-performing of the selected benchmark indexes performed.

This is also a great real-life example of how value investing works. Many of the best outperformers in the sample VIS portfolio — e.g. Hibiscus, Meta and Netflix — outperformed precisely they were acquired at incredibly cheap prices, not because of the endurance of their underlying businesses per se. And the reason why I had the “courage” to buy them at the point of maximum pessimism was because I was prioritizing risk, rather than returns. At some point, the share prices of these stocks fell to such a silly level that the risk of permanent loss of capital had became almost non-existent. It wasn’t that I knew for certain that these stocks would go up — it was that I felt that they couldn’t possibly stay down forever, and at such silly prices the upside was more than worth the risk. This sentiment is encapsulated in the following quote by Howard Marks:

“There's no asset so good that it can't be overpriced and become a bad investment, and very few assets are so bad they can't be underpriced and be a good investment.” — Howard Marks

The Next Chapter of Value Investing Substack

We are now covering exclusively US-listed stocks! Click here to find out more.

Individual Stock Performance: Best & Worst Stocks

Now that we’ve seen my sample VIS portfolio’s performance, let’s drill down into the performance of the individual stocks. Who were the best performers, and who were the worst?

Best-Performing Stock: META (+105% since Nov ‘22)

Ironically enough, one of the best performers in my sample VIS portfolio was META. I say ironic because most people would qualify Meta under the ‘growth investing’ bucket of ‘Tech megacap’ stocks — which stands in stark contrast to the colloquial understanding of a ‘cigar butt’ old economy ‘value stock’. META truly delivered to its shareholders since I wrote about it — attaining >200% returns in just 3 months, for an annualized return of 1,600%. Bill Ackman, here I come!

It’s worth mentioning that my META report started out with the above screenshot of META’s latest share price — $88.91 in early Nov 2022. This was pretty much near the absolute bottom of META’s share price following a precipitous -75% slide YoY — what some might even describe as “The Point of Maximum Pessimism”.

Would it be fair to say that I had the ocular capacity to identify that bottom? Certainly not. However, META’s share price at the time was ridiculously undervalued relative to its business’s underlying fundamentals. At a valuation of just 9x LTM PE (or my worst-case scenario of 24x PE) at the time, I could not conceive how META’s shares at that share price could possibly lead to a permanent loss of capital over a full market cycle. Hence, despite not knowing whether its share price might continue falling, simply abiding by Buffett’s Rule No. 1: Never Lose Money resulted in some MEGA-upside simply by virtue of buying cheap and holding dear.

Worst-Performing Stock: BJCORP (+20% since Nov ‘21)

BJCORP Accounting Deep-Dive - Part 3a: Profit & Loss Statement

BJCORP Accounting Deep-Dive - Part 3d: Three Statement Analysis of the Listed Berjaya Companies

BJCORP Update - Is Jalil Resigning as CEO of BJCORP? (Update: Jalil has resigned)

Wait… did you say that your worst stock gained +20% since you wrote about it in Nov 2021? Yes, read on to find out how that happened.

BJCORP was infamous for being one of my favorite stocks when I first wrote about it in Nov 2021. The story at the time was the turnaround of a significantly undervalued but mismanaged conglomerate with a ton of valuable assets — but which had not been properly monetized by the previously family-run conglomerate. The relatively minted new CEO, Jalil Rasheed, had been brought in during March 2021 to spruce up the asset base and prioritize optimal capital allocation within the company over empire building.

Unfortunately, it was reported that Jalil had left the company for personal reasons just a year later in March 2022. Whether it was actually for personal reasons we’ll probably never know, but the initial turnaround story was certainly dismantled when he resigned. From when I first wrote about it at RM 0.25, BJCORP’s shares dipped slightly below RM 0.20 for a week or two — before subsequently rebounding back to its pre-Jalil trading range of between RM 0.23 - 0.25 for nearly the rest of the year. At that point, BJCORP was perhaps the worst investment thesis on this newsletter.

However, one silver lining was that despite the investment thesis falling completely flat on its face… the company’s share price didn’t actually drop by much! BJCORP’s share price was RM 0.25 when I first wrote about it, and settled at around RM 0.23 - RM 0.25 for most of the post-Jalil period. Keep in mind that my BJCORP investment thesis was a complete wipeout — with the turnaround CEO who owned 3.6% of the outstanding shares at one point leaving before he could even implement the turnaround. In any other case, you would likely have seen a cratering in the company’s share price.

However, as a value investor the entry price is an indispensable element of the investment process — and by virtue of the share price already being wildly depressed, there just wasn’t much downside remaining. By prioritizing the downside over the upside, we hold fast to the following Soros quote as immortalized by Stanley Druckenmiller:

“It’s not about whether you’re right or wrong (that matters), but how much money you make when you’re right and how much you lose when you’re wrong.” — George Soros

By estimating our potential downside before taking a position, we can put a floor beneath our potential losses despite the uncertainty of being wrong. And since each dollar of loss offsets each dollar of gain in the stock market, good risk management can certainly contribute to higher alpha.

Hence, despite my BJCORP thesis being utterly and completely wrong… its share price only fell by a tiny amount from the starting price despite Jalil resigning! This is the essence of risk management in markets, which I’ve painted out in detail in this article:

In mid-November, the company serendipitously found itself in the news again on rumors of an acquisition of a regulated entity, which turned out to be MCIS Insurance Bhd. This propelled its share price to its current high, which I certainly did not foresee happening at the beginning. Regardless, this is why BJCORP’s stock is up +20% over a roughly 1-year period.

Actual Worst-Performing Stocks: BJFOOD (-27%), AEM (-26%), Supermax (-17%)

If we assume that the sample VIS portfolio had shorted BJFOOD (as mentioned above), then it would have lost -33% since I wrote about it in Feb 2022. At the time, I felt that its shares were overvalued — as I thought it was trading on inflated sales figures relative to pre-covid sales due to pent-up demand from lockdowns ending. This later turned out to be incorrect, as the sales increases had been justifiable due to persistent price increases.

Regardless, the main reason I didn’t find its valuation attractive at the time was because its share price could materially collapse if I was correct. Without the benefit of 20/20 hindsight and uncertainty abounding, the only prudent thing to do at the time was to observe Soros’ aforementioned quote and ask myself how much I could lose if I was wrong. That was enough to put me off from BJFOOD’s valuation at the time, despite my assumptions ultimately turning out to be incorrect.

AEM Holdings - Supplying the Lockheed Martin of Tomorrow (Part 1)

AEM Holdings - Supplying the Lockheed Martin of Tomorrow (Part 2)

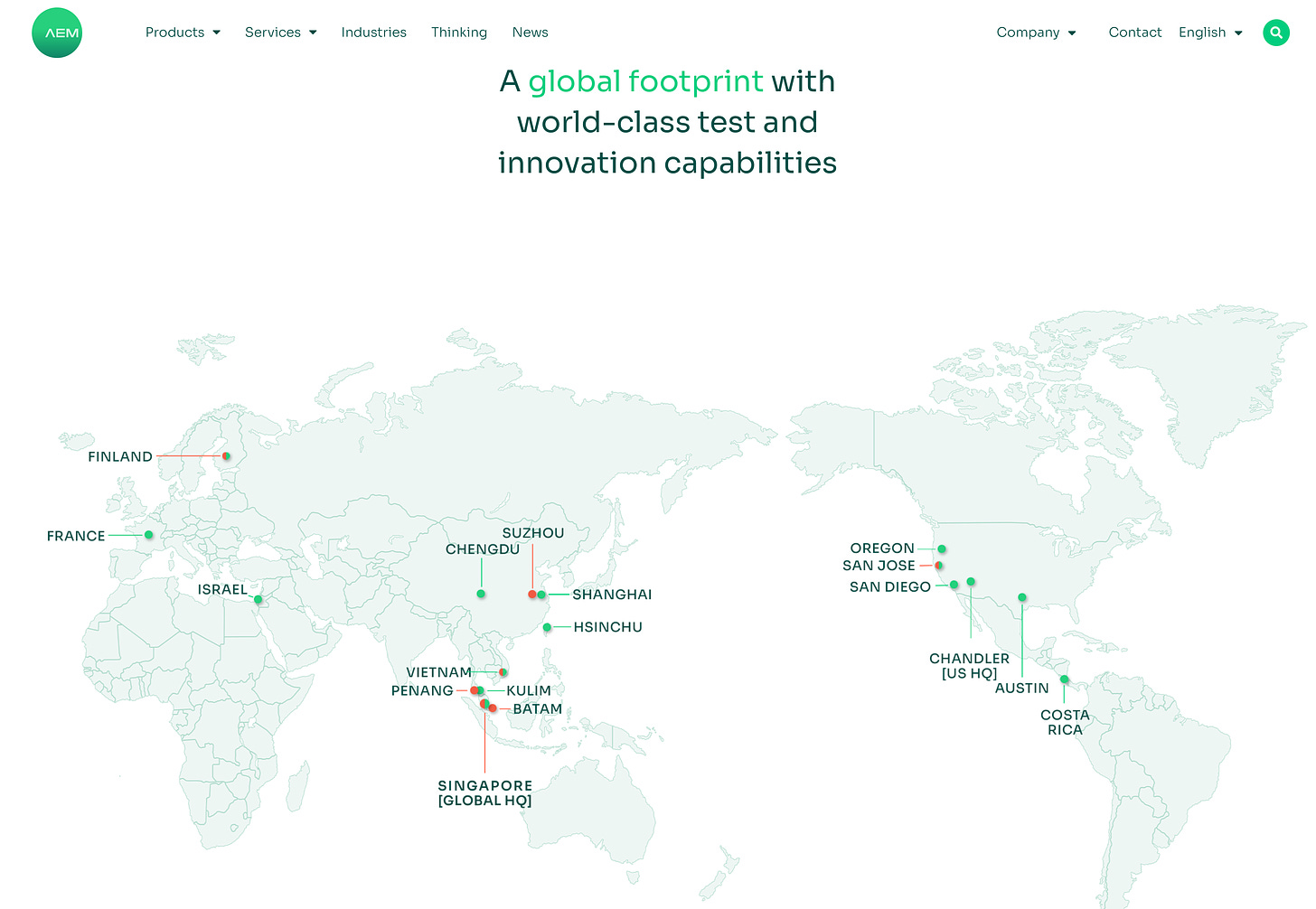

AEM Holdings still remains one of the most undervalued stocks that I’ve discussed here since I wrote about it in March 2022. As an Intel proxy, its share price basically follows the trajectory of INTC 0.00%↑'s share price — which has obviously not been doing great given the recent industry downcycle. However, the recent semiconductor news surrounding US sanctions on semiconductor exports to China will provide huge macro tailwinds to AEM — given INTC 0.00%↑'s position as one of the only three leading-edge foundries in the entire world; and AEM currently being the sole supplier of advanced testing equipment (i.e. SLT) to Intel.

AEM is an extremely cash flow generative business with highly recurring cash flows — in a sector with massive macro tailwinds behind its sector (i.e. leading-edge semiconductors). Did I mention that it pays a regular dividend too? Read my AEM Holdings report below to find out more!

Supermax also remains pretty undervalued today, although not nearly as much as AEM. It has a pretty simple business model, and their shares were pretty undervalued at RM 1.00 when I first mentioned them in March 2022. The reason for its share price underperformance since then is mostly because the glove sector that it occupies remains under significant heat due to macro headwinds. However, this isn’t a going concern risk to Supermax, as their current Net Cash position remains in excess of their entire market cap as of the latest quarter (mostly tied up as Capital Commitments, but not ring-fenced in the event of a liquidity emergency). As an aside, Top Glove (which shares pretty much the same thesis as Supermax) is up +13% to-date — simply by virtue of me writing about them 8 months later:

Keep in mind that these are the worst performing stocks in this sample VIS portfolio to-date — at -27%, -26% and -17% respectively. Given the excessively volatile macro environment of the past 3 years, pretty much nearly every other portfolio in the world would likely have had at least one stock crashing in excess of -50%, if held until the present day. Nor does this mean that I had been excessively conservative, as evidenced by stocks like META and NFLX outperforming by +105% and +102% respectively. I would submit this as sufficient evidence of the virtues of risk:reward asymmetry — which is what Value Investing is all about.

Review of VIS Portfolio Individual Stock Performance — And Updates So F

In the section below, I’ll be giving an update on ALL OF THE STOCKS in the sample VIS portfolio — i.e. what has happened since I wrote about them, and whether I still feel that their share prices are undervalued or have since become overvalued. We will be discussing the stocks here in descending order of performance — from the best-performing to the worst-performing to-date.

Second-best Performing Stock: Netflix (+102% since May ‘22)

NFLX’s share price has pretty much completely recovered to when Bill Ackman first announced that he had acquired his stake in Jan 2022 — which he subsequently dumped at a massive -40% loss just 3 months later. My NFLX thesis when I wrote about it in May 2022 was simple — it had lost its subscription-based revenue model moat, but it was also trading at a measly 17x PE at the time of writing. For a company which could stay as the 2nd or 3rd largest streaming company in the world for the foreseeable future, 17x PE seemed outrageously undervalued — even for a business in a commoditized sector. Most GDP+ growth stocks in old economy industries (e.g. Nestle, KO) regularly trade at around 30x PE.

Since then, NFLX has been in the news for its password sharing crackdown in the USA (which it recently reversed) in order to generate incremental revenues from a slowing US consumer base. However, the bigger news since I wrote my report is that all of Netflix’s major streaming competitors (e.g. Disney+ and HBO Max) have since announced a pivot towards an ad-supported tier themselves. Some industry analysts have even attributed the recent firing of former Disney CEO Bob Chapek to NFLX’s alleged deliberate move to refocus Wall Street’s attention on revenues over subscriber growth — since Netflix was the only profitable streaming incumbent.

This basically means that all of the worries which had plagued NFLX on Wall Street this time last year have since evaporated — with the new baseline for the gradually commoditized streaming sector being the ad-supported tier. The +102% increase in NFLX’s share price since I wrote about it might serve as proof of that.

Hibiscus (+47% since Oct ‘21)

I first spotted Hibiscus in April 2020 — the month in which oil prices dipped into negative territory for the first time in history. Even at $20 oil prices, Hibiscus appeared incredibly undervalued at RM 0.45/share. The thesis at the time basically boiled down to the fact that they had 2 years of remaining cash runway even at $20 oil prices — and you were betting that oil prices would rebound to above Hibiscus’s total breakeven level of ~$50. Which if you understand crude oil markets, was bound to happen eventually within 2 years. However, this performance attribution begins from Oct 2021, which was when I wrote my Hibiscus Part 3 report — hence why I am only attributing +47% gains to Hibiscus, rather than +157% since Apr 2020.

Since then, the universe has been kind to the O&G sector. Following drastic global O&G undersupply resulting from the Ukrainian War, oil prices have shot up to ~$120 in mid-2022 before settling back down to $70 today. However, the secular undersupply story which has permeated the global O&G industry since then has only gotten worse, not better. The following three excellent articles (not mine) go to great lengths to demonstrate how woeful the structural undersupply really is in both US shale and offshore O&G sectors — and how a rebounding China could potentially put enormous pressure on marginal crude oil production:

Why Won't Energy Companies Drill? | Goehring & Rozencwajg (US Shale)

Waiting Patiently for Oil . . . at the DMV | Open Insights (China reopening)

And given that Hibiscus’ share price is basically a proxy to global oil prices… well, you can finish that sentence yourself.

Innature (+38% since June ‘22)

A Love Letter to Innature Berhad (5295.KL) - The Body Shop of Malaysia/Vietnam

Innature (Part 2): The Perfect Hedge Against BOTH Inflation + Deflation

The story behind Innature has barely changed since I first wrote about them in May 2022. Firstly, this is a pretty stable ex-growth Malaysian business with pricing power in the Branded Retail sector — which also happens to have a call option on Vietnam’s GDP growth of +7% CAGR. Secondly, its share price has only increased by +10% since I first talked about them — which doesn’t really change the valuation narrative since then.

As I mentioned in both of the above articles, shareholders are basically being paid to sit pretty holding low-risk retail exposure and wait for the next retail upcycle — all while collecting a sweet dividend yield of 5% (probably closer to 4% today). Top that of with the fact that Innature is an excellent portfolio hedge against both inflation and deflation at the same time, and you’ve got a wicked cool EM growth profile.

Padini (+35% since Nov ‘21)

I can’t actually take full credit for Padini’s eye-popping +35% outperformance since I had merely mentioned it in passing when it first caught my eye in Nov 2021. At the time, it just looked incredibly cheap on the surface — and some cursory analysis led me to believe that it might be worth spending more time on. However, it wasn’t a high-conviction idea at the time as Padini is just your average retail chain — albeit one that is beginning to build a brand for itself in the region.

Padini’s recent outperformance is basically just a return-to-the-mean story — as the wider retail environment improved from the previously pandemic-affected years, and an influx of Chinese tourists are expected following China’s reopening. It’s probably worth noting that Padini booked a record profit in 4Q22, mainly resulting from increased footfall in malls as lockdowns were gradually released.

7-11 Malaysia or SEM (+33% since Dec ‘21)

7-11 Malaysia was in the news recently on rumors that a bid had been submitted by the $376B US private equity firm Carlyle Group to acquire its subsidiary Caring Pharmacy. SEM’s share price rose by +50% for a week or two at its peak, before subsequently giving up all its gains — and then climbing back up +30% from trend on the aforementioned BJCORP news (both are majority-owned by the same founder).

As I detailed in the above SEM report written in Aug 2022, I’m quite doubtful that SEM can justify its current valuation at RM 2.00 even with the aforementioned sale of Caring Pharmacy. At my admittedly conservative valuation of 20x normalized PE, Caring Pharmacy would only be worth around RM 600M. Even if we were to optimistically assign Caring with a valuation of 33x PE (or RM 1B), that would still give the residual 7-11 Malaysia business an extended valuation of RM 1.5B — relative to the Group’s current market cap of RM 2.5B. This would imply a ~30x PE for 7-11 Malaysia, which grows to ~50x EV/E if you include debt.

The only way the Caring Pharmacy acquisition can be justified at the reported inflated bid of USD 400M is if their inflated pandemic-period profits become normalized into perpetuity. That’s simply not an assumption I’m willing to risk, since the downside would be massive if I were wrong.

SABECO (+13% since Feb ‘22)

SABECO is Vietnam’s second largest brewery, effectively splitting Vietnam’s entire beer market share with the globally recognized brewery Heineken. Newcomers to the stock can basically think of SABECO as being the Kweichou Moutai of Vietnam — the latter of which is a fledgling frontier market with forecasted GDP growth of +7% CAGR over the next decade.

As some of you may be aware of, the leading regional brewery ThaiBev acquired a majority stake in SABECO a few years ago. In Sept 2022, market rumors sprung up that ThaiBev was considering a spin-off of its SABECO stake — but this news was promptly denied by ThaiBev later. With Vietnam’s economy resuscitating from the pandemic (amidst a China-style property meltdown), SABECO’s share price has risen by +13% from when I wrote about it in Feb 2022 given its classic GDP+ growth profile.

Top Glove (+13% since Oct ‘22)

The story behind TOPG was pretty simple when I wrote about it in Oct 2022. Its shares appeared undervalued at just 11.6x normalized PE — given its incredibly simple ‘steady growth via reinvestment of retained earnings’ business model, and its current stature as the world’s largest glove manufacturer. This was basically a similar narrative to NFLX’s shares in May 2022 — which has risen by +102% since then.

Nothing much has changed since I wrote my TOPG report 3 months ago… so check it out below if you need a refresher!

SEA Ltd (+12%) — “Short” since May ‘22

Oh boy… this one is a doozy. Following my report written in May 2022, SEA Ltd’s share price fell all the way to the mid-$40’s from an all-time high of ~$350 (-80%)… before climbing back up to its current level of $70.

I probably don’t need to regale the rollercoaster ride that Shopee (SEA’s primary e-commerce segment) has been an involuntary participant of in 2022, since it has been plastered all over the news by now. But just as a refresher, they:

Is it overvalued today at $70? As I noted in my previous report, their shares weren’t dramatically overvalued at $80 — given that they are presently the dominant e-commerce operator in South East Asia — but they were far from undervalued too. The conservative investor in me would probably start wondering if it’s undervalued at closer to $40. It’s not like there aren’t literally thousands of other fish in the SEA.

Canadian National Railway (+7% since July ‘22)

In both of the reports above written in July 2022, I highlighted that Class 1 US Railroads were the picks & shovels of the US Commodities sector — the latter of which was expected to see soaring prospects over the next decade. The latter commodities thesis has more or less already played out as expected so far — with hard commodities like copper and O&G already seeing signs of buckling under the woefully stratospheric undersupply plaguing their futures.

As a Class 1 Railroad, the diversified nature of CNI’s sprawling business means that its share price won’t be quite as volatile as most businesses. However, US Congress passed an 11th hour bill in Dec 2022 to avert a rail strike after railroad unions protested against the harsh working conditions under the Precision Scheduled Railroading approach adopted by the industry (as discussed in my railroad industry primer). Aside from that, not much has changed at CNI’s railroad business since I first wrote about it in July 2022.

AirAsia or Capital A (+4% since Apr 2022)

After two tumultuous years of lockdowns, AirAsia’s planes have finally taken to the skies. At this point, there is almost negligible risk of the COVID-19 pandemic gripping the global economy with ruthless lockdowns again — so for now at least, it seems that AirAsia is in the clear. And with China recently lifting its lockdowns as well, it would seem that ASEAN airlines stand to benefit enormously from the pent-up demand of returning Chinese tourists (especially Thailand, which sources ~20% of its GDP from its tourism sector).

However, one thing still gives me pause. Firstly, it was reported awhile back that the airline had been given until March 2023 to comply with certain conditions by the local airline regulator — with those conditions being undisclosed to the public. Soon after, it was announced that AirAsia’s listed parent entity Capital A was considering spinning off the former into the listed entity of AirAsia X (AAX), its long-haul LCC airline arm — thus creating a combined LCC airline with both short-haul and long-haul business units (akin to modern FSCs). Anyone who is familiar with how unsustainable the economics of the long-haul LCC sector is will know that this is a terrible idea. And with the current shareholders of Capital A being compensated for the spin-off with shares in AAX, their exposure to the fortuitous short-haul AirAsia airline is expected to be forcefully diluted with long-haul AAX exposure.

This came out of left field for me and frankly grinded my gears — because my preference for was only for exposure to the excellent short-haul AirAsia airline, not the dismal long-haul AAX airline. There is a possibility that Capital A may be considering turning the long-haul unit into a traditional long-haul FSC — since there’s nothing stopping them from retrofitting their widebody AAX jets for an FSC business. Such a move would essentially turn AAX into an FSC airline business — but to be clear, this is an extremely unlikely prospect and remains deep in the domain of speculation.

Pentamaster HK (1665.HK) (+1% since Oct ‘22)

Unlike AEM which operates in the prized leading-edge semiconductor space, Pentamaster operates in the highly commoditized trailing-edge semiconductor space in its supply of ATE testing equipment. However, the US sanctions on semiconductor exports to China announced in Nov 2022 is expected to be equally beneficial to Pentamaster’s industry — as China is expected to control the trailing-edge semiconductor manufacturing sector TAM going forward (e.g. automobiles, IoT, 5G basestations). Pentamaster and its other semiconductor brethren located in Penang, Malaysia are expected to benefit significantly from this semiconductor trade war — given that Penang commands 7% of the global TAM of the trailing-edge semiconductor testing equipment industry.

However, there are a bit of mixed blessings here, as the dual-listed Pentamaster HK shares hasn’t appreciated nearly as much as their sister Pentamaster MY shares since I wrote about them in Oct 2022. Pentamaster MY shares have increased by +27% to-date; while the Pentamaster HK shares with identical underlying exposure have only increased by a measly +1%. This persistent difference in the valuation of the dual-listed shares isn’t new, as it has been ongoing for the past few years already — but there may yet be some reprieve for Pentamaster HK if the underlying business can successfully execute on its plan to supply the China EV market over the coming years.

Poh Huat (+1%), Do Day Dream (-10%) & Bukalapak (-3%)

BUKALAPAK 2077: The Future Pinduoduo of ASEAN's China (Part 1)

BUKALAPAK x SALIM: Planning for Indo-Pacific Domination (+China!) (Part 3)

Nothing much has happened at either Poh Huat, Do Day Dream or Bukalapak since I wrote about them over a year ago. Poh Huat’s furniture manufacturing business is basically a proxy to North American residential real estate; while Do Day Dream’s business is a proxy to Chinese tourist arrivals in Thailand (which gets ~20% of its GDP from tourism).

Hence, Poh Huat’s near-term prospects don’t appear very enticing — whereas Do Day Dream’s short-term outlook looks dreamy indeed. With the reopening of China’s economy and the recent announcement that lockdowns between the mainland and Hong Kong would be completely lifted, the skies are clear for Do Day Dream’s profits to experience liftoff throughout the rest of 2023 — their shares are already up by nearly +15% since China’s zero-covid policy was lifted in early Dec 2022.

Likewise, not much has changed at Bukalapak since I wrote about it — as it has only been less than 3 months since my first report in Nov 2022. If you’d like a refresher, do catch up with one of the 3 Bukalapak reports linked above.

MYNEWS (-13%) — “Short” since May ‘22

However, MYNEWS’ share price crashed by -25% overnight almost exactly one month later on dismal quarterly results owing to pandemic-related factors. At the time, I felt a wave of relief that I had done the right thing by being upfront to everyone about my mistaken analysis. It would have absolutely crushed me had I stayed silent and knowingly caused others to lose money.

As chance would have it, MYNEWS’ performance actually improved significantly over the remaining 2nd half of the year (partly due to an improving retail sector) — to the point where it is now UP by +13% relative to when I first wrote my MYNEWS report in May 2022. Notably, the company’s founder and CEO had been buying shares from the open market nearly every week after the crash, acquiring most of his post-crash stake at around RM 0.45 (now: RM 0.70).

As a result, recognizing my mistake actually led this “short” narrative to underperform! But don’t worry, I’ll still continue being radically honest if I notice any mistakes in my future stock analyses :)

Special Mention: BAT Malaysia (+9% since Jan ‘20)

This BAT Malaysia report was written in Jan 2020, immediately prior to the beginning of the COVID-19 pandemic. Hence, it doesn’t actually fall within the aforementioned 16-month performance timeframe of 4Q21 - Jan ‘23. However, I know that some readers were especially interested in it, and thought it deserved an update.

The context at the time was that most stocks were trading at their 5-year highs in Jan 2020 — even before the Federal Reserve released the QE hounds when the pandemic hit — and BAT Malaysia was one of the few local stocks at the time that still seemed reasonably priced. It was then trading at 9x PE, 13% normalized dividend yield and sported a 100% ROE.

3 years later, BAT Malaysia’s shares remains trading at roughly the same valuations — 13.5x PE, 7% dividend yield and 70% ROE. This may or may not be an attractive yield to you depending on the investor — but one thing that has become clear to me since I wrote that report is that global governments are on a war path to crush the global cigarette industry. At first, I thought that this was just a uniquely Malaysian phenomenon and that the depressed share price of BAT Malaysia more than justified its political risk. There was room for the onerous political will to inflect in the opposite direction given the socioeconomic pressures involved (i.e. rapid rise in market share of contraband cigarettes over the past 5 years), while the downside remained capped.

However, other governments including New Zealand, UK, and Massachusetts have also recently jumped on the cigarette hate bandwagon — which led me to realize that this was actually a concerted effort by the global government regime to stamp out cigarettes from society, rather than being exclusively a Malaysian one. If so, then perhaps the roughly 10x PE of BAT Malaysia could be reasonably justified as an ex-growth business in a sunset industry.

Conclusion

So does value investing work? You bet it does. In contrast to the popular narrative, adopting a risk management focus actually can lead to better results — as evidenced by how the value investing methodology enabled me to catch both NFLX and META at close to their bottoms. If you truly understand the concept of risk:reward asymmetry, you aren’t limited to investing only in diversified index funds like the S&P 500 — since you are actively mitigating risk within each stock position. Lower risk than investing in indexes, but higher reward!

By approaching investments through the lens of risk:reward asymmetry, value investors are simply relying on the timeless laws of nature to carry them to +15% CAGR returns — such as observing prudent statistical distribution of probabilities (i.e. bell curve) and the 8th wonder of the world, the compound interest phenomenon. As long as you Never Lose Money, you are almost guaranteed to achieve any reasonable financial goal you set out to attain with value investing.

Refresh your memory with these Value Investing articles!

If you enjoyed this article, consider supporting this newsletter with an annual subscription!

The Next Chapter of Value Investing Substack

We have since switched to covering US stocks! Click here to find out more!